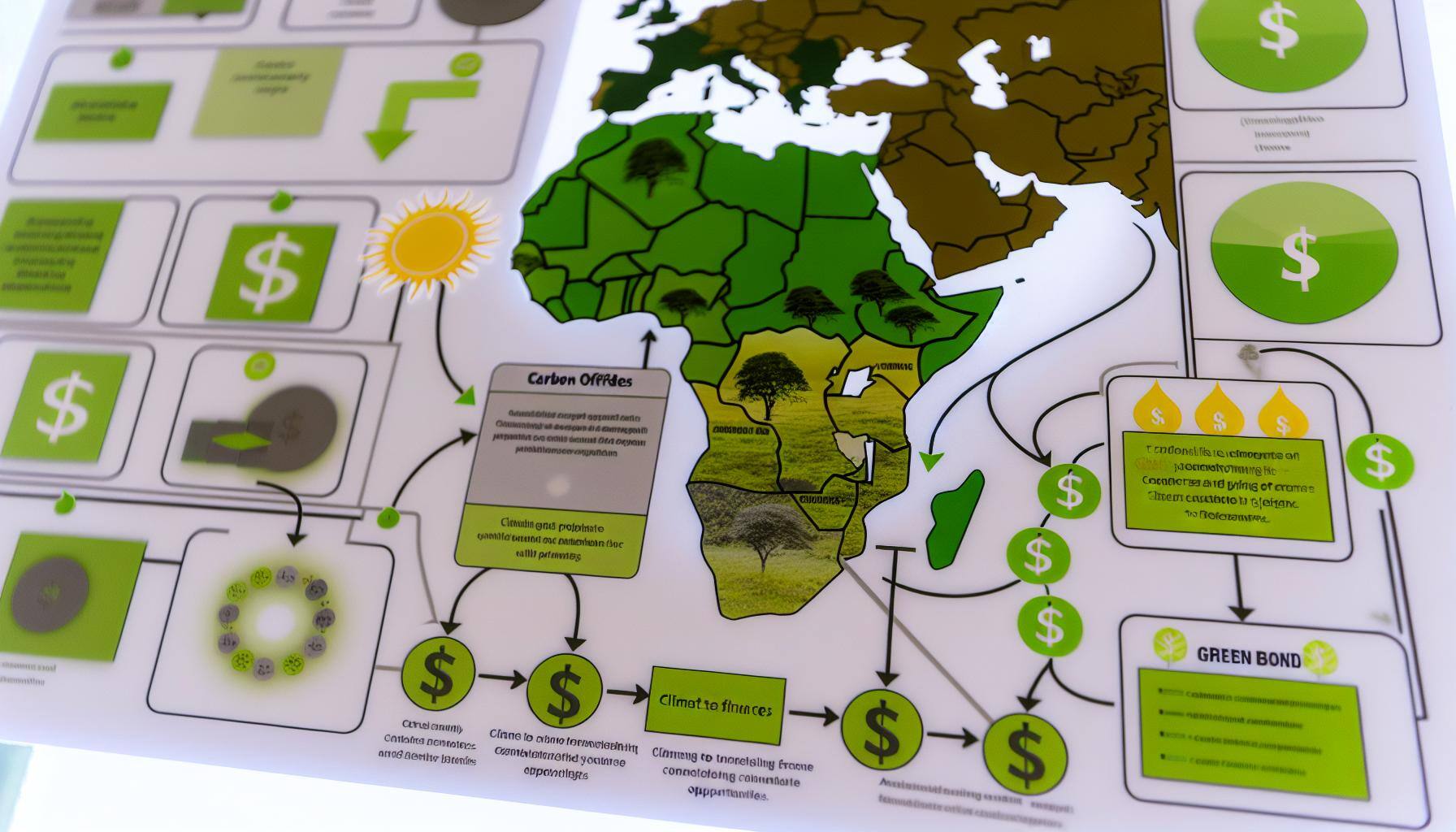

Do you want to explore how Africa's entry into the carbon credit market can promote economic growth and environmental sustainability? With the Zero Circle team and our development partner and advisor for West Africa, Tidiane Coulibaly, we explore the untapped potential of Africa's carbon credits and their impact on global sustainability efforts.

Africa, with its rich natural resources and diverse ecosystems, has the potential to play a significant role in the global carbon market. The continent's vast forests, wetlands, and grasslands can sequester carbon, making it a prime candidate for generating carbon credits.

However, Africa currently accounts for only 2% of the global carbon market. The Africa Carbon Markets Initiative (ACMI), launched at COP27, aims to significantly expand African participation in voluntary carbon markets, producing 300 million carbon credits annually by 2030 and 1.5 billion credits annually by 2050Carbon credits are crucial to mitigating climate change and reducing greenhouse gas emissions. They represent a unit of measurement for carbon dioxide or other greenhouse gases offset or reduced from an industrial process or activity. Carbon credits incentivize businesses and organizations to reduce their carbon footprint and invest in cleaner technologies by assigning a monetary value to these reductions.

Understanding the importance of carbon credits is crucial for Africa's sustainable development. As the continent experiences rapid economic growth, there is a need to balance this growth with environmental sustainability. Carbon credits can provide a mechanism for African countries to transition to low-carbon economies, attract investment in renewable energy projects, and contribute to global climate goals.

Benefits of Developing Africa's Carbon Market

Developing Africa's carbon market offers several benefits, including:

Increased private sector engagement and investment

By purchasing carbon credits from Africa's carbon markets, companies can channel investment toward climate change mitigation, adaptation, and resilience in the communities where carbon projects are located. This accelerates the flow of private capital to Africa and can reduce risk for future private investment in clean energy and other sectors.

Image source: Industrial Revolution

Channeling climate finance to where it is needed most

Developing Africa's carbon markets can catalyze funding by moving money to where it is most needed. This new financing stream can help the communities and countries least responsible for emissions and yet hurt the most by climate change adapt and remain resilient in the face of climate shocks.

Image source: Landscape

Funding net-zero development

The carbon market and carbon credits can unlock greater public and private investment, and African governments can generate export revenue to invest in furthering sustainable development. Carbon market development could significantly transform the energy sector in Africa, derisking and catalyzing financing for renewable energy projects and attracting more global investment.

Challenges and Opportunities in Africa's Carbon Credit Market

Africa's carbon credit market faces unique challenges and opportunities. One of the main challenges is the lack of awareness and understanding among key stakeholders, including governments, businesses, and local communities. This hinders the adoption of carbon credit projects and limits the potential for revenue generation and sustainable development.

However, Africa has significant opportunities in the carbon credit market. The continent has vast renewable energy resources, such as solar, wind, and hydroelectric power, which can be harnessed to generate carbon credits. Additionally, Africa can benefit from international partnerships and funding mechanisms, such as the Green Climate Fund, to support the development of carbon credit projects and infrastructure.

Key Players and Initiatives Driving Growth

Several key players and initiatives are driving the growth of Africa's carbon credit market. International organizations, such as the United Nations Framework Convention on Climate Change (UNFCCC), play a crucial role in creating regulatory frameworks and standards for carbon credit projects. They guide and support African countries in developing their carbon markets and accessing international carbon markets.

At the national level, governments and regulatory bodies are implementing policies and incentives to promote carbon credit projects. These include feed-in tariffs, tax credits, and renewable energy targets. In addition, private sector actors, such as project developers, investors, and carbon credit aggregators, are actively involved in financing and implementing carbon credit projects in Africa.

A Roadmap for Realizing Africa's Potential in Voluntary Carbon Markets

To unlock the potential of VCMs in Africa, stakeholders must take deliberate and thoughtful action. The following roadmap outlines the steps required to realize this potential:

Establish clear policy frameworks

Governments should develop policy frameworks that encourage the development of VCMs and provide a conducive environment for investment in low-carbon projects. This includes setting clear rules and regulations for carbon credit issuance, verification, and trading.

Image source: Policy Framework

Build institutional capacity

African countries should invest in building institutional capacity to manage VCMs effectively. This includes developing technical expertise, establishing robust monitoring and reporting systems, and building partnerships with international organizations and the private sector.

Promote transparency and integrityTransparency and integrity are essential to building trust and confidence in VCMs. This includes implementing robust monitoring and reporting systems, ensuring that projects are additional and verified by independent third parties, and promoting transparency in the pricing and trading of carbon credits.

Foster private sector engagementAfrican countries should engage with the private sector to promote investment in low-carbon projects and the development of VCMs. This includes creating enabling environments for private-sector investment, encouraging public-private partnerships, and incentivizing businesses to participate in VCMs.

Leverage international partnershipsAfrican countries should leverage international partnerships to access technical expertise, financing, and market opportunities. This includes engaging with international organizations, such as the United Nations Framework Convention on Climate Change (UNFCCC), the World Bank, and the International Finance Corporation (IFC), to access funding and technical assistance for developing VCMs.

Constraints to Carbon Market Development in Africa

Several constraints hinder the growth of carbon markets in Africa. The scarcity of climate data and insufficient analytical capabilities across the continent impede the identification and development of viable carbon offset projects. Limited industry oversight and accountability, coupled with limited awareness and understanding of carbon markets among policymakers, businesses, and communities, pose significant challenges to growth.

Reference: Barbara K. Haya, Aline Abayo, Ivy S. So, Micah Elias. (2023, December). Voluntary Registry Offsets Database v10, Berkeley Carbon Trading Project, University of California, Berkeley. Retrieved from: https://gspp.berkeley.edu/faculty-and-impact/centers/cepp/projects/berkeley-carbon-trading-project/offsets-database

Moreover, inconsistent or under-developed legal frameworks and governance complexities, such as unclear land tenure and ownership rights, hinder the establishment of clear regulations, standards, and incentives necessary to operate carbon markets successfully. These challenges necessitate strategic policy measures and regional collaboration platforms to address existing constraints and establish a conducive environment for Africa's thriving and resilient carbon market.

According to our West Africa partner, Tidiane Coulibaly, ECOWAS plans to set up a highly ambitious regional carbon market using a bottom-up harmonization method.

Nigeria, Côte d'Ivoire, and Ghana are leading initiatives in developing the carbon market in West Africa.

- Nigeria: Nigeria's National Climate Change Council (NCCC, established in 2021) is currently working on the formalization of a nationwide carbon market, which is due to be implemented before the end of the year. This should include both the mechanisms of Article 6 of the Paris Agreement and voluntary carbon credits.

- Côte d'Ivoire: Côte d'Ivoire also intends to implement a regulatory framework on carbon mechanisms (currently being validated) that could cover both Article 6 mechanisms and voluntary carbon markets. Its many initiatives give it a specific political focus. Côte d'Ivoire asks Rabobank to suspend carbon credit activities in the country pending the implementation of a concrete regulation that meets the country's expectations.

- Ghana: Ghana is finally working on legislation to regulate the production of carbon credits, even though the country is already a model in the region. The Ghana Carbon Market Office (CMO) was set up in 1994 to support implementing projects under the Kyoto Protocol.

Zero Circle's Role in Fostering Critical Mass for Carbon Market Implementation

Zero Circle, a leading company in the carbon market, is helping to achieve the critical mass needed to implement the carbon market in Africa by addressing these challenges through the following ways:

- Education and Awareness: Zero Circle is working to increase awareness and understanding of carbon markets among key stakeholders, including governments, businesses, and local communities. This includes providing educational resources, training programs, and workshops to build capacity and promote the adoption of carbon credit projects.

- Transparency and Integrity: Zero Circle is committed to promoting transparency and integrity in the carbon market. This includes implementing robust monitoring and reporting systems, ensuring that projects are additional and verified by independent third parties, and promoting transparency in the pricing and trading of carbon credits.

- Policy Advocacy: Zero Circle advocates for developing clear policy frameworks and regulatory standards to support the growth of carbon markets in Africa. This includes working with governments and regulatory bodies to develop policies and incentives that promote carbon credit projects and provide a conducive environment for investment in low-carbon projects.

- Private Sector Engagement: Zero Circle engages with the private sector to promote investment in low-carbon projects and developing African carbon markets. This includes creating enabling environments for private-sector investment, encouraging public-private partnerships, and incentivizing businesses to participate in carbon markets.

- Regional Collaboration: Zero Circle is leveraging international partnerships to access technical expertise, financing, and market opportunities. This includes engaging with international organizations, such as the United Nations Framework Convention on Climate Change (UNFCCC), the World Bank, and the International Finance Corporation (IFC), to access funding and technical assistance for developing African carbon markets.

Impact

By addressing these challenges, Zero Circle is helping to achieve the critical mass needed to implement the carbon market in Africa. This includes increasing private sector engagement and investment, channeling climate finance to where it is needed most, and funding net-zero development. Additionally, Zero Circle's efforts are contributing to the growth of Africa's carbon market, which has the potential to significantly transform the energy sector in Africa, derisking and catalyzing financing for renewable energy projects and attracting more global investment.

Côte d'Ivoire Role in Africa's Carbon Market Development

Côte d'Ivoire plays a significant role in Africa's carbon market development, particularly through its commitment to the African Continental Free Trade Area Agreement (AfCFTA). By participating in the AfCFTA, Côte d'Ivoire is part of a broader economic integration framework, facilitating the flow of goods, services, and investments across African markets. This integration can catalyze the growth of carbon markets by creating a larger and more interconnected market for carbon credits and sustainable products.

Furthermore, Côte d'Ivoire is well-positioned to benefit from the AfCFTA, ranking 17th among all African nations in the 2019 Africa Regional Integration Index and being the strongest among all ECOWAS members regarding regional integration. The country's focus on strengthening regional integration, particularly in trade, macroeconomic, productive, and infrastructure integration, indicates its commitment to regional cooperation and development.

Côte d'Ivoire can contribute by developing African productive capacity at all renewable energy supply chain points, including strategic minerals mining, photovoltaics scaling, and green fuel production in Africa's transition to zero-carbon economies. This transition will create millions of new jobs in Africa, directly through the construction and operation of renewable energy infrastructure and indirectly through the growth of related industries and services.

Côte d'Ivoire's role in Africa's carbon market development includes:

- Its commitment to regional integration.

- Focus on regional value chains.

- Potential contributions to the transition to zero-carbon economies in Africa.

- Investments in capacity-building initiatives.

Conclusion

Carbon markets offer a promising tool for mitigating emissions and driving sustainable development in Africa. By understanding the characteristics, performance, and constraints of carbon markets in the region, we can chart a roadmap for unlocking its potential in the global carbon credit market. Through strategic policy measures, regional collaboration, and a commitment to addressing existing challenges, African nations can establish a thriving and resilient carbon market and contribute to climate change mitigation, sustainable development, and economic growth.